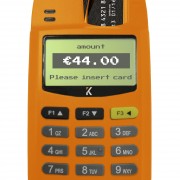

Card use extending to smaller purchases as contactless catches on

Growth in the volume of debit and credit card purchases in the UK continues to outstrip the growth in value as consumers use their cards more frequently for lower value payments. A threefold increase in contactless payments was a factor in the trend.