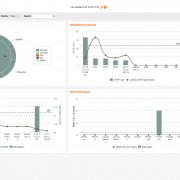

Capital markets firms “woefully” underestimate IT costs

Capital markets firms often have little idea how much they are spending on technology and even less control, according to a new report by Tabb Group and Thomson Reuters. The report’s authors call for greater emphasis on data, which could help to save the half a million dollars per front office employee spent on technology every year.