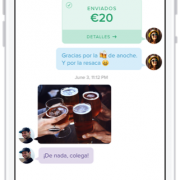

Payments app Circle launches in Europe

Payments services provider Circle has commenced its operations in Europe, starting with euro availability in Ireland and Spain. The expansion will enable people in the EU/EEA region to send and receive person-to-person (P2P) payments with native Euro support to friends and family within their countries and across borders instantly – with zero fees.