Amazon looking to buy Capital One?

Amazon is rumoured to be pondering the acquisition of Capital One. Banking Technology contacted both parties for a comment but received no response.

Amazon is rumoured to be pondering the acquisition of Capital One. Banking Technology contacted both parties for a comment but received no response.

US-based brokerage services provider Convergex has implemented Ancoa’s market surveillance platform to monitor all trading activity across its domestic and international cash equities and options businesses. It also monitors trading activity of “all lit and dark venues” including Millennium, Convergex’s proprietary applicant tracking system (ATS). The cloud-based deployment is running on Amazon Web Services (AWS), […]

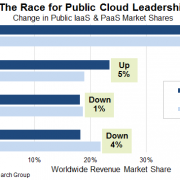

Synergy Research has released its latest findings for the global cloud computing market, painting a worrying picture for any challengers looking to cash in on the craze.

Amazon Web Services (AWS) has launched Financial Services Competency to certify its partners that specialise in the financial services space.

Singapore-based DBS Bank has signed an agreement with Amazon Web Services (AWS) to use its cloud technology. The bank envisages shifting up to 50% of its computer workload to cloud within a two-year period. With this deal, DBS will create a hybrid cloud environment “optimised” for rapid changes of capacity and functionality, which is “complementary” […]

Corezoid, a US-based provider of a Platform-as-a-Service (PaaS) solution to banks, has announced that its product can now be delivered on the Amazon Web Services (AWS) cloud. Corezoid’s offering is a process engine for banks to create a digital core. It “allows banks to rethink all of their operations as a set of states and […]

A technical outage of the Amazon Web Services (AWS) cloud this weekend left many customers of Australian banks unable to use cards, ATMs and Eftpos terminals. The banks affected include Westpac, ME Bank and Commonwealth Bank of Australia (CBA). Some also pointed the finger of blame at payment providers such as First Data. Just a […]

Over the past few years the financial industry has started to reinvent how it operates. Organisations are changing the way they serve their potential and existing customers, while maintaining the high levels of compliance and security that their customers and regulators require. The technologies available today mean that financial services organisations aren’t constrained in the way they once were. They can now access secure and compliant technology, on-demand, in the cloud which is helping them to create new ways to bring value to customers. But not all financial institutions have been able to take advantage of these technologies in the same way as newer entrants to the market have