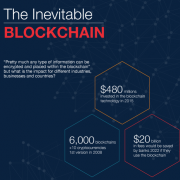

Financial Stability Board muses implications from fintech

Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system, has issued a report analysing the potential financial stability implications from fintech.