UK mobile payments held back by security and complexity

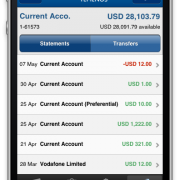

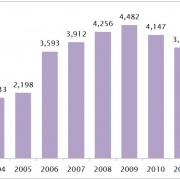

With only one in five UK consumers using their mobile to make payments, new research suggests that the technology is being held back by consumer fears over security, lengthy sign-up processes and problems making payments outside of individual schemes.